July 16th Newsletter

The significant number of COVID vaccinations in our area has enabled me to connect with many constituents at their homes in recent weeks. The first question I ask them is “how are you and your family doing?” as I try to assess the impact of the pandemic. Fortunately, most of the people I have met in the 73rd District have responded that they are doing well, having been able to maintain their jobs, had their children return to school, and stayed healthy. Other families continue to face daunting challenges, however, and need help getting a job, restarting a business, and affording childcare.

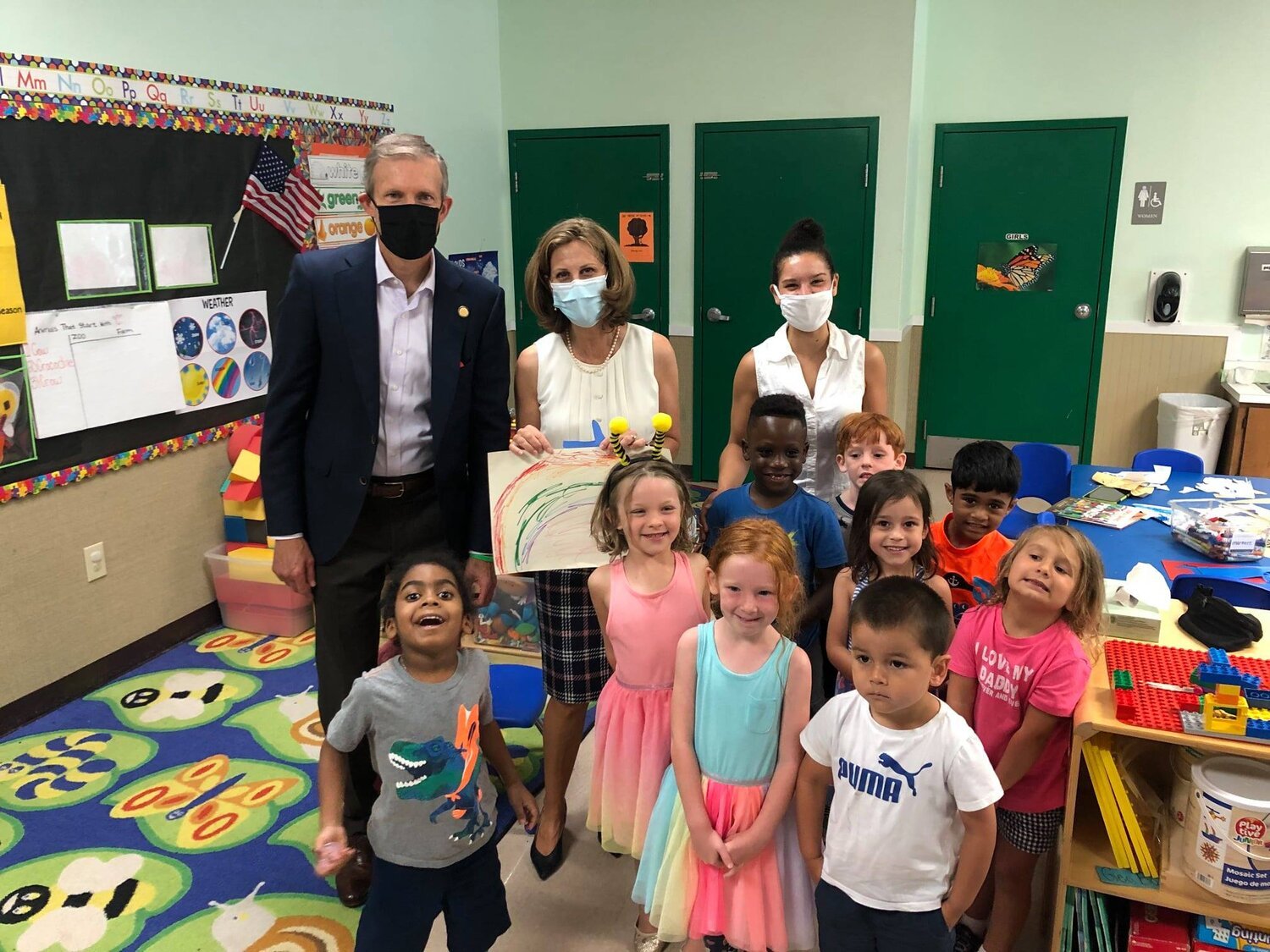

We have summarized below several initiatives underway to continue or expand support for businesses and families. Those efforts include Governor Northam’s proposal to substantially increase funding for the Rebuild VA program that assists small businesses and nonprofits with direct funding. I also was very pleased to join First Lady Pamela Northam at a local child care facility following the Governor's announcement of the expansion of Virginia’s Child Care Subsidy Program. And as a reminder, my office is continuing to assist constituents who are having difficulty obtaining state unemployment benefits.

If you have any questions or need assistance with a state agency, please contact my office at delrwillett@house.virginia.gov or phone at 804-698-1073, and a member of my staff will be happy to assist you. I also will continue to keep you informed with relevant, accurate information via Twitter, Facebook, and my website. Please stay well and stay in touch.

Sincerely,

Rodney

New Information

Virginia Named “America’s Best State for Business” Back to Back 2019 and 2021

This week CNBC named Virginia “America’s Best State for Business” for a record-breaking second consecutive year (CNBC did not publish 2020 rankings due to the pandemic). Despite the economic hardships of the COVID-19 pandemic, Virginia has built a stronger and more resilient economy that is attracting investments from major industries and job creators. This honor is based on 10 categories, including the cost of doing business, infrastructure, business friendliness, access to capital, education, workforce, and cost of living.

This year CNBC also analyzed the quality of life, inclusion, and access to health care. Over the past two years, we have instituted non-discrimination policies in the workplace, expanded broadband access to our rural communities, and protected and ensured every citizen’s right to vote. We also placed an emphasis on education, working hard to pass legislation promoting worker training, investing in our school systems, and removing barriers to higher education. These changes have made our Commonwealth more welcoming and inclusive to businesses and workers and show the strength of our pro-employer and pro-worker platforms. You can see more information on CNBC’s process for their rankings online here.

Virginia has previously won this title in 2007, 2009, 2011, and 2019. This year, Virginia surpassed Texas for most years as the top state for business since CNBC debuted its ranking in 2007. You can see more information on this historic announcement online here.

Governor Northam Proposes $353 Million in American Rescue Plan Funding to Accelerate Small Business Recovery

Virginia has received $4.3 billion in aid from the federal government as part of the American Rescue Plan. The Governor has called a special legislative session to convene on August 2nd so that members of the General Assembly can vote to allocate this funding. This week, Governor Northam proposed an investment of $353 million to support small business recovery. As a small business owner and entrepreneur, I know how challenging this past year has been for local business owners, and I am thrilled that we have an opportunity to provide crucial support to targeted industries and small businesses.

The proposal includes $250 million in additional funding for the Rebuild Virginia Program. Launched in August 2020, Rebuild VA has provided $120 million in federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funding to more than 3,000 small businesses and nonprofits. The additional $250 million will provide relief for businesses that were unable to receive support in 2020, as well as opportunities to provide additional grants to new applicants.

Additionally, the Governor has proposed $50 million for Virginia Tourism Corporation initiatives. Travel and hospitality have long been an impactful revenue generator for the Commonwealth, and from March 2020 to April 2021, Virginia lost an estimated $14.5 billion in total tourism spending. Governor Northam is proposing a $50 million investment to help the tourism industry recover and restore additional economic activity across the Commonwealth. The Virginia Tourism Corporation (VTC) will create the Virginia Tourism Recovery Program to deliver funding to all 114 destination marketing organizations throughout the Commonwealth.

Finally, Governor Northam is proposing $53 million for the Industrial Revitalization Fund and the Virginia Main Street program. The Industrial Revitalization Fund helps jumpstart industrial projects through a collaborative approach with local governments and assistance with site identification, location preparation, and the transformation of derelict structures to increase the number of shovel-ready projects. The funding will also support Virginia Main Street’s Technical Assistance Grant program, which has proven to be a successful tool for revitalizing small towns. This increased investment will be focused on providing support for minority and immigrant communities, as well as woman- and minority-owned businesses.

I look forward to working with my colleagues during our special session this summer to allocate this funding and provide additional relief to ensure that our small businesses have the resources they need to come back stronger and more resilient than before. If you applied for a Rebuild Virginia grant and did not receive funding or have questions about this new funding please contact my office at DelRWillett@house.virginia.gov.

Virginia Revenue Surplus Reaches $2.6 Billion for FY 2021

On Wednesday, Governor Northam reported that Virginia reached the end of fiscal year 2021 with an historic $2.6 billion surplus, the largest in the Commonwealth’s history. All major general fund revenue sources exceeded their forecasts for the fiscal year. Individual non withholding taxes, one of the Commonwealth’s most volatile revenue sources, accounted for about half of the surplus, although collections in payroll withholding, sales, and corporate income taxes were also well above their respective forecasts.

You can see more information and preliminary data on our FY2021 revenues online here. Final figures for fiscal year 2021 will be released on August 18th at the Joint Money Committee meeting with members of Senate Finance and Appropriations, House Appropriations, and the House Finance Committees.

Payroll withholding and sales tax collections, 80 percent of total revenues, and the best indicator of current economic activity in the Commonwealth, finished $560.2 million or 3.3 percent ahead of the forecast. This is a strong indicator that we have effectively managed Virginia’s finances throughout the pandemic. This surplus, combined with the $4.3 billion in federal aid from the American Rescue Plan is a tremendous opportunity to make transformational investments in our Commonwealth.

IRS to Distribute Advance Child Tax Credit Monthly Cash Benefits Beginning July 15th

On July 15th the IRS distributed the first monthly cash payments funds from the federal Child Tax Credit (CTC) to eligible families with children ages 17 or younger. The new enhanced credit is part of a government effort to use the tax code to help families weather the ongoing challenges of the pandemic. President Joe Biden's American Rescue Plan authorized an expansion of the CTC, which has existed since the late 1990s, to more quickly provide monthly checks to households. The expansion boosts the credit from $2,000 to $3,600 for each child under 6 or $3,000 for children ages 6 to 17. Eligible households will receive monthly payments through December 2021.

To qualify for advance Child Tax Credit payments, you, and your spouse if you filed a joint return, must have:

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return; or

Provided the IRS with your information in 2020 to receive the Economic Impact Payment using the Non-Filers: Enter Payment Info Here tool; and

A main home in the United States for more than half the year (the 50 states and the District of Columbia) or file a joint return with a spouse who has a main home in the United States for more than half the year; and

A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number; and

Made less than certain income limits.

See online here for more information from the IRS on this program and to check your eligibility.

The Child Tax Credit has an income cutoff of $75,000 for single taxpayers and $150,000 for joint filers to receive the full payment, with payments reduced by $50 for every $1,000 of income above those limits. The payments phase out entirely for single taxpayers earning $95,000 and joint filers earning $170,000. For more information on this program please visit ChildTaxCredit.Gov

Extension of Expanded Child Care Subsidy Program for Virginia Families

Last week the Governor and First Lady announced the extension of the expanded eligibility for Virginia’s Child Care Subsidy Program for Virginia Families. Earlier this year, I co-sponsored HB2206 by Speaker Filler-Corn, which established a new short-term eligibility category for parents seeking financial assistance for child care while looking for employment and temporarily increased the income eligibility criteria. The expanded eligibility makes financial assistance for child care available to families with at least one child under age five who is not yet in kindergarten, with a household income up to 85 percent of the state median income. This expansion nearly doubles the previous income threshold in many regions of the Commonwealth and is the highest eligibility level in Virginia history. Families approved for the subsidy will remain eligible to receive benefits for 12 months, or until their income exceeds 85 percent of the state median income. The expanded eligibility was set to expire on July 31, 2021, but the Governor has directed the Virginia Department of Education to use existing federal funding to continue covering co-payments for families through December 31, 2021.

You can see more information and apply to the program online at childcareva.com. I encourage all constituents with children under five to check their eligibility to take advantage of this historic opportunity. To celebrate the extension of this expanded eligibility, I joined First Lady Pam Northam and Secretary of Education Atif Qarni at Tuckaway-Barony Child Development & Early Education Center in the 73rd district for Child Care Access Month of Action. Access to child care is crucial to our economic recovery, and I am thrilled that more Virginia families will be eligible for support under this program.

Maternal Health Awareness Month

Thanks to resolution HJ111 from Delegate Cia Price, July is Maternal Health Awareness Month in Virginia. This resolution raises awareness of the significant racial disparities in maternal health outcomes in Virginia. Black women are 2.4 times more likely than white women to die during pregnancy or within one year of pregnancy from any cause related to or aggravated by the pregnancy or its management, but not from accidental or incidental causes. In Virginia, Black women are 1.9 times more likely to die using the same measure than their white counterparts. In addition to raising awareness, we have taken steps to improve health outcomes for mothers through establishing a Maternal Mortality Review Team within the department of health and provided funding to extend healthcare coverage for pregnant women from 60 days to 12 months postpartum through FAMIS (Family Access to Medical Insurance Security Plan), Virginia’s CHIP program.

You can see more information on maternal mortality online here. If you are pregnant and in need of health care coverage, please apply to FAMIS MOMS online at coverva.org. With FAMIS MOMS there are no enrollment fees, monthly premiums (costs), or co-pays for pregnancy-related services. FAMIS MOMS also covers breast pumps and breastfeeding support during your pregnancy and after your baby is born.